As a refresher, BLE Risk Index of 1.0 is considered average risk. The lower the number, the lower the risk and the higher the number, the higher the risk.

Strategy #1: Loans with BLE Index below a specified value

The easiest way to use the BLE Risk Index during loan selection process might be to select loans on the basis of BLE Risk Index below a specified value. Very conservative lenders may consider selecting loans with BLE Risk Index below 0.90, while moderately conservative lenders may select loans with BLE Risk Index below 1.10.PeerCube makes this strategy easier by listing loans with lowest BLE Risk Index under menu Lending Club -> Loan Review -> Low BLE Risk Loans. As the screen capture shows below, most available loans with BLE Risk Index below 0.90 are likely to be Grade A and B loans with Interest Rate as high as 12.12%. The moderately conservative lender can pick loans up to Grade D with interest rate as high as 19.72% while keeping the BLE Risk Index below 1.10.

Selecting loans solely on the basis of BLE Risk Index is the quickest way to make lending decisions. But in my opinion, this strategy may not be appropriate for most lenders because it puts too much faith on the current applicability of methodology used in a 1940 research and PeerCube's ability to implement the methodology correctly after 70 years.

At present, both concerns are valid ones and can't be ignored before adopting this strategy. The additional questions may arise about the "right" BLE Risk Index number for a lender and foregoing additional returns possible by increasing the threshold value, as previously discussed as part of BLE Index Caveats.

Strategy #2: Loans with lowest BLE Index in Each Credit Grade

This strategy is slight variation of previous strategy. Instead of relying on absolute specific value of BLE Risk Index, it relies on the relative risk as represented by BLE Risk Index.One way to use relative risk is choosing loans with the lowest BLE Risk Index within a Credit Grade. This strategy will enable lenders to capture higher interest rate offered by higher credit grade while minimizing the BLE Risk Index within that credit grade.

We plan to utilize similar strategy in our new account with Lending Club. Our lending strategy with new account will be to:

- Invest in total seven loans per week.

- Invest in loans from all credit grade per week.

- Invest in one loan per day.

- Invest in loan with the lowest BLE Risk Index in each credit grade.

- Not review loan details or any other quantitative and qualitative criteria.

Strategy #3: BLE Index as additional criteria with Filtered Loan Results

I believe this strategy is the most prudent among the three strategies discussed in this post. With this strategy, a lender considers BLE Risk Index as a data point for review after filtering available loans based on other loan and borrower parameters.The advantage with this strategy is similar to the second strategy discussed above. Instead of linking BLE Risk Index with Credit Grade, as in the second strategy, this strategy links the BLE Risk Index with a lender's filtering criteria. A lender can choose to include either BLE Risk Index below a specified value or relative value of BLE Risk Index among loans available after filtering.

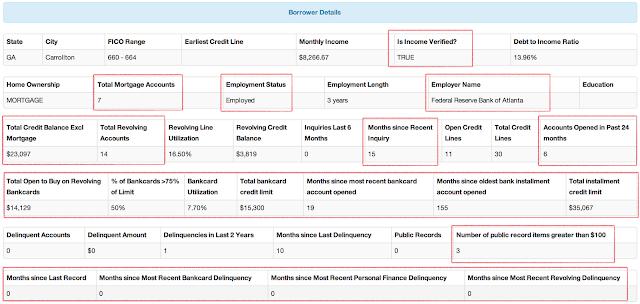

PeerCube now lists BLE Risk Index alongside the major loan and borrower parameters for filtered loan as shown below. This change facilitates easier consideration of BLE Risk Index.

Personally, I use BLE Risk Index with Founders' Filter in my current portfolio. I consider filtered loans with BLE Risk Index below 0.90 first and then loans with index below 1.10. I typically minimize investing in filtered loans with index above 1.10.

Hopefully, these examples will help readers come up with more creative and appropriate strategies leveraging PeerCube platform. Please share through comments how you are using BLE Risk Index in your selection process for Lending Club loans.

Note: I am currently on vacation. For next three weeks, posts and responses to comments will be infrequent.