Previously, I analyzed Loan Issued Date, Interest Rate, Application Date, Credit Grade, Loan Length, and Loan Amount. The common theme among these loan parameters was that none of them are directly reported by borrowers.

Now let's look at some of the loan parameters that are only reported by borrowers. These parameters typically don't require proof from borrowers and have no secondary method of confirmation such as credit report. Personally, I consider such parameters at best subjective and subject to manipulation.

Loan Purpose

The Loan Purpose parameter indicates the purpose for which the loan will be used for. Lending Club currently has fourteen pre-defined purposes:- Car

- Credit Card

- Debt Consolidation

- Educational

- Home Improvement

- House

- Major Purchase

- Medical

- Moving

- Renewable Energy

- Small Business

- Vacation

- Wedding

- Other

As the chart below shows almost 2/3rd (66.22%) of the all loans issued since 2007 on Lending Club platform are reported with purpose of Debt Consolidation and Credit Card. Individually, less than a percent of loans are issued for Renewable Energy, Educational, Vacation and House Purchase purposes.

The chart below shows the distribution of loan purpose as a function of application date. 2012 is turning out to be a blockbuster year when borrowers are reporting debt consolidation and credit card purpose for almost 3/4th (74.21%) of the loans. Even in 2008 when we went through financial crisis and following year, we don't see such an high level of activity. Will all loans reported to be used for debt consolidation and credit card pay off used for such purpose? I am skeptic.

Loan Status

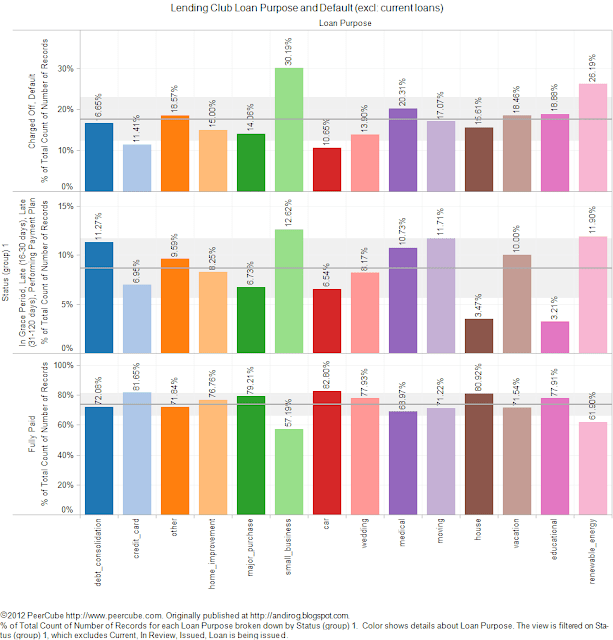

The chart below shows the loan status as a function of loan purpose for all loans issued since 2007. The loan status of defaults and charged off for loans with purpose of Small Business, Education, and Energy seems to concerning. The chart seems to be validating impression by lenders that debt consolidation and credit card loans are better and renewable energy, educational, and small business loans are bad. Is it really true?Are we seeing influence of high volume of recent loans issued with debt consolidation and credit card purposes and not enough loans for energy, education, and business? This was the first doubt came to my mind. Let's see if we can figure out ways to take out the influence of volume growth year over year and higher volume of recent loans for debt consolidation and credit card purposes.

I decided to exclude loans with loan status of Current, In Review, and Being Issued. The assumption is that most loans in such status are recent loans. The chart below shows the loan status excluding loans with current, in review, and being issued status as a function of loan purpose. While the education loans don't stand out as a sore thumb when comes to defaults, the defaults of small business and energy loans are still very high and medical loans become a suspect too.

The chart below shows loans with default and charged off status as a function of loan purposes and application year. One observation right away stands out is the higher than normal defaults for loans for small business purpose. Over the years, loans for moving, education, medical, house, and renewable energy purposes have proven to have higher than normal defaults also.

Key Takeaways

- Anecdotal observation of miss-classification of loan purpose to debt consolidation and credit card, the default rate data doesn't support this observation.

- Lenders need to closely watch loans for small business, renewable energy, moving, education, medical, and house purchase purposes as such loans have higher than normal default rate.

This comment has been removed by a blog administrator.

ReplyDeleteYour analyses are all about default rates. It would be much more relevant to compare ROI.

ReplyDelete